Autoplan Insurance

Prepare for your renewal

You can renew an ICBC insurance policy as early as 44 days before it expires, whether over the phone, in person or online – we'll mail you a renewal reminder letting you know. Learn more about what you’ll need and find the renewal method that works for you.

Things to know before you renew

You can renew a policy as early as 44 days before it’s due to expire.

Renewing online for the first time? If you haven’t previously used the BC Services Card app or Interac® verification service to sign into another online service, we recommend setting up your preferred sign-in option at least a few days before you start your renewal.

Watch our video about your secure sign-in options:

Both options verify your identity during the initial set-up, and this verification can take up to a few days to complete.

What you'll need to renew

We recommend gathering the following before starting your renewal:

Your renewal reminder and insurance documents

The birth date and B.C. driver’s licence number (or out of province driver's licence number and jurisdiction) of any drivers you’d like to add to your policy during the renewal

Your vehicle’s odometer reading if you want to be considered for a usage-based discount

*please note that discount eligibility requires two odometer readingsYour credit card (to pay in full) or bank account information (to pay in installments)

How to renew your ICBC policy

We offer three methods for renewal. You can choose whichever one works best for you.

In person: you can renew at any Autoplan broker’s office in B.C.

Online: if you’ve got an eligible policy, you can renew it online.

Over the phone: contact any Autoplan broker to renew over the phone. You may also be able to renew by email, but check with your broker to determine if that’s an option.

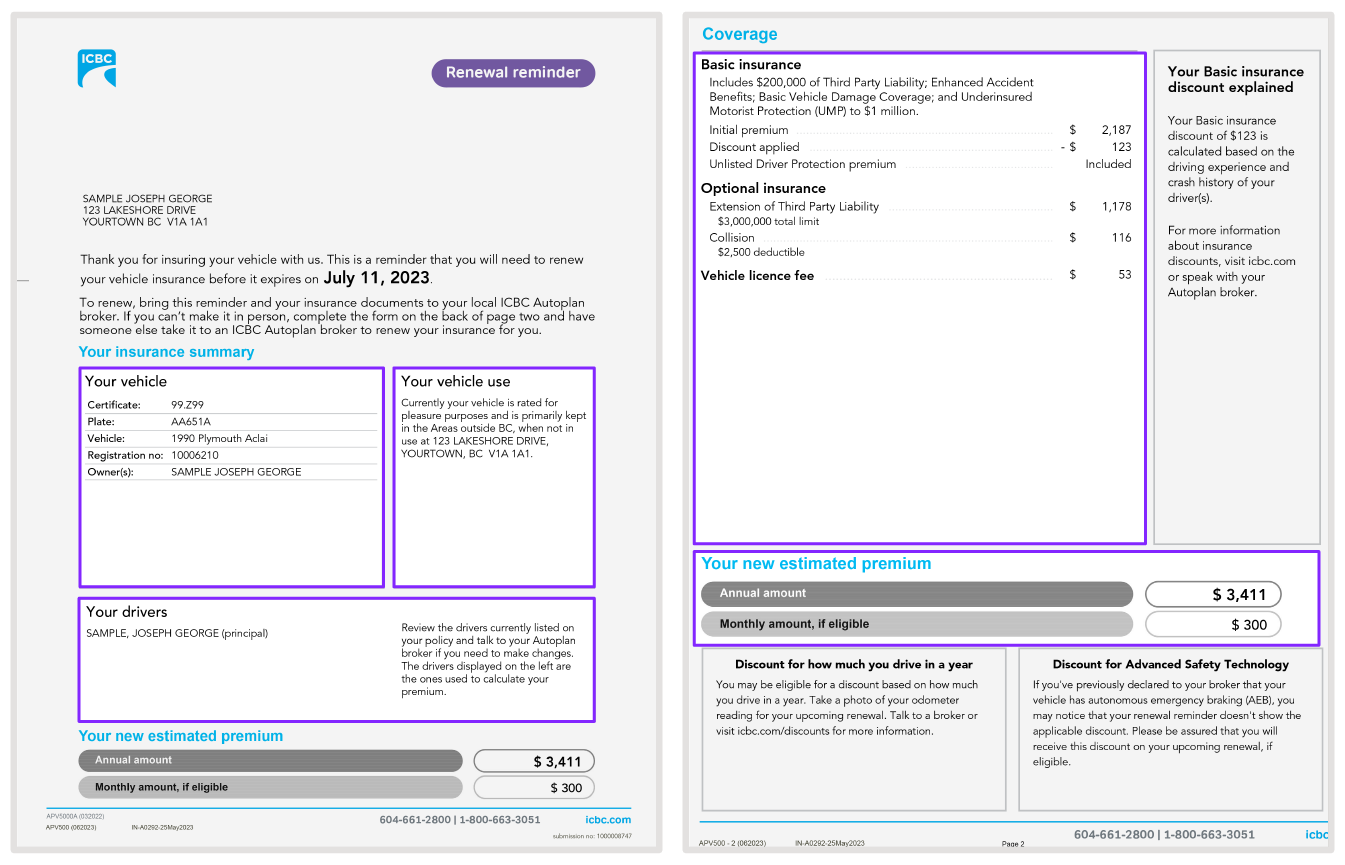

Understanding your renewal reminder

Most insurance renewal reminders provide an estimate of the cost of your insurance for the same duration and coverage as the previous policy term (typically, one year).

Your estimated premium is the total (annual, monthly) cost of your Basic Autoplan insurance and any optional coverage purchased through ICBC.

If you're thinking about making changes to your policy before you renew, such as adding a driver or changing your coverage, you can estimate your insurance costs using our online tool. You’ll need to sign in with either your BC Services Card app or Interac® verification service to prepare your estimate.

Your renewal reminder, explained

Your vehicle

Find out how to submit your odometer reading to get a distance-based discount on your ICBC optional insurance.

Your vehicle use

Your drivers

Unlisted Driver Protection is automatically applied on policies free of charge. As long as unlisted drivers do not cause a crash in any of your cars, this protection will continue to be free.

Learn more about Unlisted Driver Protection and drivers you should list.

Your coverage

This section of your renewal reminder provides a breakdown of your current coverage, split between Basic Autoplan insurance and optional coverage.

ICBC and the B.C. government have announced no overall change in Basic insurance rates until April 2025. This means there has been no overall increase since the last increase in April 2019.

Your deductible and surcharges

Increasing repair and replacement costs are putting significant market pressure on all auto insurers – including ICBC. Technology is making our vehicles safer but also more complex, with crash avoidance technologies, cameras and sophisticated operating systems. These new advancements are very exciting — but it also means our vehicles are becoming more expensive to repair, with many manufacturers using custom and proprietary parts. ICBC reviews our Optional coverage rates on a quarterly basis and adjusts them in response to changing market conditions and current claims costs.

Your new estimated premium

Tickets, fines and penalties

Before renewing your licence, you'll need to pay any outstanding amount that you owe to ICBC or the provincial government, including provincial violation tickets, penalty point premiums and any Autoplan debt. Unpaid debt could affect your ability to renew or upgrade your licence. If you have outstanding debt with us, please call Account Services (604-661-2723 or 1-800-665-6442) prior to booking an appointment. For more information about when we refuse to issue a licence, please see the relevant section of the Motor Vehicle Act.

If you have frequent or serious driving convictions resulting from violations, your premium costs for Collision and Third Party Liability coverages will be impacted.

Contact us if you have questions about your debts or payments.