Newsroom

ICBC Enhanced Care refunds on their way

May 13, 2021

Starting next week, ICBC will begin moving forward with issuing millions of Enhanced Care refunds to eligible customers.

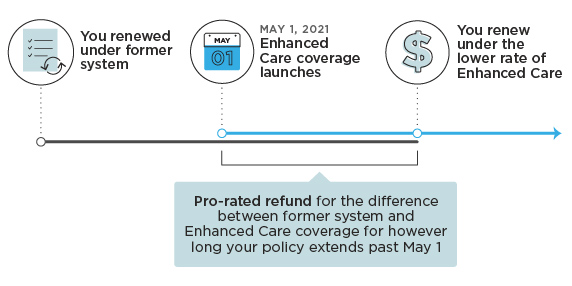

With the launch of Enhanced Care on May 1, ICBC insurance now costs less. Savings started automatically on May 1 and that means ICBC will be sending millions of British Columbians a one-time, pro-rated refund. Each customer's refund amount will be for the difference between what they paid when they last renewed their current insurance policy and the new, lower cost of Enhanced Care, for however long their current policy extends past May 1st.

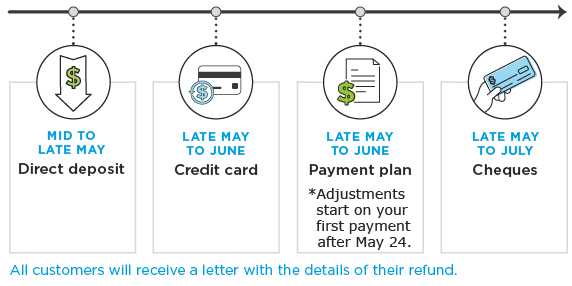

Customers who are eligible for an Enhanced Care refund will receive a personalized letter explaining the amount they are being refunded for each eligible vehicle they insure. These letters will detail how the refund will be returned to customers based on how they paid for their insurance:

Customers who paid using a credit card will receive a refund to that credit card. If your credit card has expired or ICBC is unable to validate this method of payment, you will receive a cheque.

Customers who paid by cash or debit will receive a cheque in the mail, or a direct deposit into their bank account if they are eligible and have signed up.

ICBC payment plan customers will receive their refund in the form of adjustments to their monthly payments, which will now be lower.

With millions of refunds to process, it will take some time for all refunds to be sent to customers. No matter when their refund arrives, customers can be assured they will be getting the full refund they are entitled to receive. Below is a general timeline by which ICBC will be issuing Enhanced Care letters and refunds, starting mid-May:

Customers who are eligible for an Enhanced Care refund can use ICBC's online estimator tool to see their estimated refund.

ICBC estimates the average Enhanced Care refund will be approximately $150 but some will be for more, while others will be for less. There will also be a number of refunds for just a few dollars or less. Since policy renewal dates vary between customers, some customers will receive low value refunds if their policy only extends a short time – for example, a few days or less – beyond May 1st, while customers with policy renewal dates later in the year and into 2022 would typically see higher value refunds.

ICBC is committed to ensuring customers receive every dollar that is owed to them from the move to Enhanced Care. If all the lower value refunds of $5 or less were added together, it would total approximately $1 million – a significant amount of money which ICBC firmly believes deserves to go back to its customers.

Backgrounder

Enhanced Care refunds are different from the average 20 per cent annual premium savings drivers will see when they first renew their insurance under Enhanced Care. They are also separate from the COVID-19 rebate cheques issued to eligible customers in April.

ICBC will be processing approximately 3.95 million Enhanced Care policy refunds and expects to issue the vast majority by the end of July. In exceptional cases, refunds may take longer for a variety of reasons such as a previous payment method failing, a customer having multiple policies that require additional processing and handling time or a customer not providing a correct mailing address.

Some additional information for customers with specific forms of vehicle ownership or payments includes:

If you have a leased vehicle, your Enhanced Care refund cheque may be jointly issued to include the name of your leasing company as they are considered the registered owner of your vehicle. If your leasing company is named on the cheque, you will need to contact them to have them sign the back of the cheque. If your leasing company is not named on the cheque, no signature is needed. Contact your leasing company if you have questions.

Payment plan customers will see their refund in the form of lower monthly payments going forward from May 25th onwards. For example, if a customer's monthly payment is normally taken on the 15th of every month, the customer will begin seeing lower payments on June 15th. Whenever you receive your new adjusted rate, your refund amount will be spread out evenly over your remaining payments. Any residual amount will be returned to a customer by cheque, unless they are eligible and have signed up for direct deposit.

In most cases, customers with multiple policies will receive one Enhanced Care refund summary letter outlining their refund on all their policies. The payment method for each policy will be outlined and refunded via the same method where possible.

Some customers may receive a lower-than-average refund due to various factors, including those whose current policy only overlaps May 1st by a number of days or weeks, or seasonal vehicles like motorcycles and trailers since their insurance typically costs less.

Some customers may not be eligible for an Enhanced Care refund. This includes niche categories of customers whose risks have not changed under Enhanced Care such as long-haul vehicles and out-of-province buses and limousines.